- [ 메디채널 황정호 기자 ] Two in five (40 per cent) Australian homeowners admit to taking a "set and forget" approach to maintenance, putting their homes at risk of preventable damage and claims, according to Allianz's new Home Care Report.

- At the same time, home claims are increasing with Allianz managing more than 78,000 home-related claims in 2024 (excluding those caused by natural catastrophes) – a near 5% increase on 2023.

- Many homeowners are more focused on creating a space that looks and feels personal, with 39 per cent prioritising visual appeal and 35 per cent adding personal touches over routine maintenance.

- Allianz is calling on Australian homeowners to prioritise essential home maintenance, with simple, practical actions that may help to reduce preventable claims and protect their homes and insurance coverage.

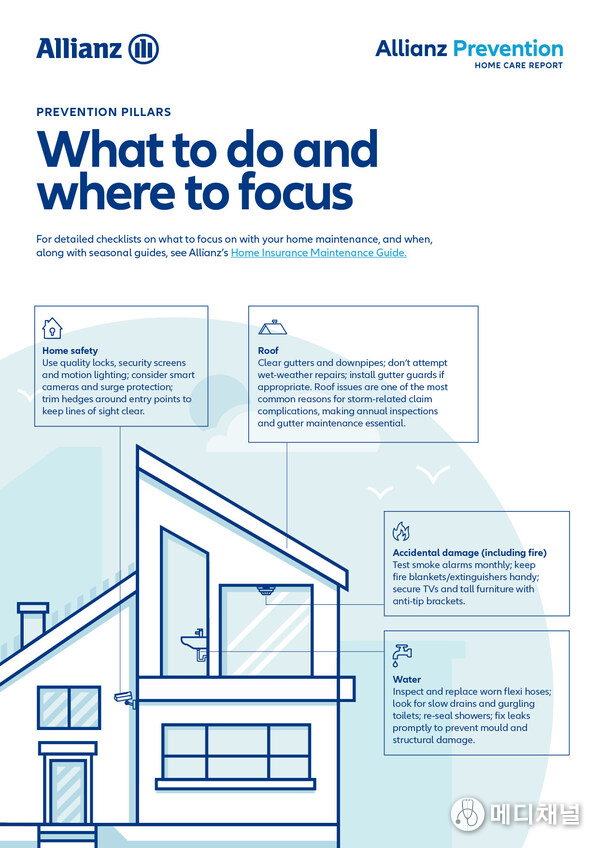

- To help reduce this maintenance gap, Allianz's Home Care Report provides practical home maintenance tips. Allianz has also been trialling a new Home Health Check service, designed to help homeowners identify and address issues early, boosting homeowners' confidence in the resilience of their homes.

SYDNEY, Oct. 1, 2025 -- Australians feel a sense of care towards homeownership, often taking great pride in their homes, and viewing them as a reflection of hard work and a place to build memories. Yet new research commissioned by Allianz Australia shows that while most homeowners (94 per cent) understand the risks of neglecting home maintenance, and almost 90 per cent agree maintenance is worthwhile, turning good intentions into consistent action remains difficult, with time, cost and effort often getting in the way.

A surprising number of homeowners are taking a "set and forget" approach, with two in five (40 per cent) admitting they don't maintain their homes regularly, or at all. In fact, only 16 per cent act when they remember and 12 per cent when someone else prompts them, meaning small issues can easily slip through the cracks. This reactive mindset often leads to minor problems becoming expensive repairs, particularly in areas like water leaks and roofing, where early fixes are far more affordable. For example, Allianz recorded more than 19,000 claims involving burst pipes and water damage, some of which may have been avoided with basic maintenance, such as changing a flexi hose, checking seals, or replacing ageing fixtures.

The research also found that home ownership is not without its challenges for Australians, with a notable minority describing it as a long-term source of stress. Cost-of-living pressures and upkeep responsibilities are key stressors, with 35 per cent of surveyed homeowners citing financial strain and around a third (32 per cent) pointing to ongoing maintenance as a reason for feeling disengaged with owning a home. The findings demonstrate a strong opportunity to help educate Australian homeowners and encourage a shift from reactive to preventative care, making home maintenance less stressful and more manageable and cost-effective over time.

With the volume of home-related claims rising, it's also an important reminder of the responsibility of homeowners to maintain their homes under their insurance policy. With most insurers having a general exclusion for 'wear and tear', the financial impact for home owners could be significant if issues aren't addressed early. For example, while insurance may cover damage from an insured event such as a hailstorm, it may not cover damage from issues that have developed over time as a result of wear and tear or lack of maintenance.

To help homeowners bridge this maintenance gap, Allianz has launched its first Home Care Report, a free online resource that explores both the immediate and long-term impacts of home care and general maintenance. The report goes beyond highlighting the risks of neglect, offering handy tips and practical advice from Allianz and property industry professionals. It provides simple, easy-to-action steps homeowners can take to better maintain their properties, reduce the likelihood of costly damage, and save on expenses over time.

Allianz has also been trialling its new Home Health Check service throughout 2025, with positive feedback from customers paving the way for potentially broader availability in 2026. The Home Health Checks have been carried out in over 200 customers' homes and include interior and exterior inspections, leak detection, mould assessment, drainage checks, and evaluation of taps, fixtures, and flexi-hoses. The offering was developed to address a clear gap in the market, informed by Allianz claims data, that showed customers may be able to avoid some home insurance claims by staying on top of simple and inexpensive maintenance, saving them time, inconvenience, and money.

"At Allianz, we deeply care about our customers and understand that their homes are more than just assets, they're spaces our customers take great pride in and where they create memories and feel safe. We also understand that keeping up with maintenance can be challenging, from a time, cost and know-how perspective," said Shez Ford, Chief General Manager Consumer, Allianz Australia.

"That's why helping our customers protect their homes is so important to us. Through initiatives like our Home Care Report and Home Health Check program, we're offering practical guidance that may help homeowners prevent costly damage, and improve the maintenance of their homes, " concluded Shez.

Leading property renovator and founder of Ace Properties Agency, Rebecca Cardamone, added, "When assessing homes, we often come across issues such as water damage, leaking pipes or mould, which are problems that could have been prevented with simple, routing upkeep. Not keeping up with maintenance not only increases risks of incidents but also undermines a property's long-term value. Regular and proper maintenance protects a home's immediate liveability as well as saving customers time, inconvenience, and money by preventing repairs from needing to be made."

The study also found generational differences, with younger and newer homeowners tending to show greater diligence, while more experienced owners are more likely to admit lapses when it comes to home maintenance.

Adding to the challenge is a shift in priorities. Four in five surveyed homeowners (78 per cent) say their approach to maintenance has changed since buying their first home, with more focus on visible upgrades, like new appliances or aesthetic improvements, rather than essential maintenance. Social media also plays a role: 24 per cent say it influences how they manage their homes, and 15 per cent admit they now prioritise looks over long-term upkeep.

With many homeowners delaying upkeep until problems escalate or prioritising aesthetic improvements, Allianz is encouraging Australians to take a proactive approach to essential home maintenance. By addressing small issues early, homeowners can better protect their homes and avoid unnecessary costs.

For more information visit allianz.com.au/prevention.

About the research:

The research was commissioned by Allianz and conducted by YouGov in accordance with the Australian Polling Council standard. The survey is a nationally representative sample comprising 1,007 Australian homeowners aged 18 years and older, conducted online between 13 August and 18 August 2025.

About Allianz Australia:

Allianz Australia delivers a wide range of personal, commercial, and corporate insurance products and services to more than 4 million policyholders. It also provides support for workers compensation insurance to around 25 per cent of the top 200 ASX companies, making it one of the leading workers compensation insurers in Australia.

Website Facebook Instagram Twitter YouTube