[ 메디채널 황정호 기자 ] WIP Capital Investments Pty Ltd (ACN 686 632 066) as trustee for WIP Capital Investments Trust (the Issuer)

MELBOURNE, Australia, Oct. 13, 2025 -- The Issuer would like to offer institutions the opportunity to participate as a noteholder under a loan note deed poll, dated as of 27 May 2025, as amended from time to time (the Loan Note Deed) in respect of notes to be issued by the Issuer under the Loan Note Deed, as described in more detail in the commercial terms sheet attached to this offer letter (the Notes). The proceeds of the Notes will be used by the Issuer to, among other things, make investments that are consistent with the Investment Plan set out in the trust deed of the WIP Capital Investments Trust (the Trust).

For the purpose of carrying out certain regulated activities, the Issuer is appointed by Wingate Financial Services Pty Ltd (ACN 106 480 602) (the Investment Manager or Licensee) as its corporate authorised representative. This offer letter, and any offer in respect of the Trust, will be made by the Licensee under an intermediary authorisation agreement between the Issuer and Licensee, where the Licensee will make offers to arrange for the issue, variation and disposal of financial products in connection with the Trust. The Issuer will then issue the financial products in accordance with the offer, if it is accepted.

Tax Act Public Offer

The Notes will be documented under the Loan Note Deed in accordance with section 128F of the Income Tax Assessment Act 1936 (Cth) of Australia (the Tax Act). This letter constitutes an offer to issue the Notes in accordance with the "public offer test" in subsection 128F(3) of the Tax Act.

It is intended that the Notes will be issued in a manner that satisfies the public offer test and other requirements of section 128F of the Tax Act. Accordingly, Offshore Associates (as defined below) of the Issuer will not be permitted to acquire an interest in the Notes.

Participants will be required to make customary representations, warranties and covenants regarding their status to ensure compliance with Australia's interest withholding tax exemption regime, and in particular, will be asked to confirm that except as disclosed to the Issuer at the time of this offer, they are not so far as they have actual knowledge, an Offshore Associate of the Issuer.

In this letter, "Associate" has the meaning given in subsection 128F(9) of the Tax Act and "Offshore Associate" means an Associate who would acquire an interest in the circumstances specified in subsections 128F(5)(b) and (c) of the Tax Act.

General Conditions of Participation

Final allocations will be determined by the Issuer in its absolute discretion. The Issuer reserves the right to scale back or accept oversubscriptions, and to withdraw this offer at any time or close or extend the review period for considering this offer at any time before or after the stated date for receipt of responses.

Each offered investor must independently make its own credit analysis and decision to enter into the transaction.

Principal Terms

The details of the Loan Note Deed are set out in the term sheet in Schedule 1 to this letter (the Term Sheet).

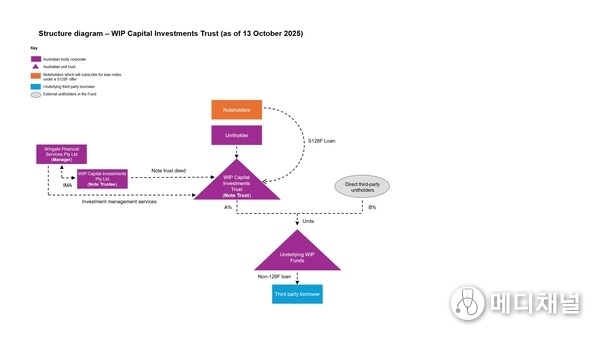

Structure Diagram

The structure diagram included in Schedule 2 to this letter (the Structure Diagram) is provided for illustrative purposes to assist prospective investors in understanding, in summary form, certain aspects of the proposed structure relating to the offer of the Notes. It does not purport to depict all legal, tax, accounting or operational considerations relevant to the offer or the structure. The Structure Diagram may be subject to change and such changes may not be reflected in the Structure Diagram. No representation or warranty is made by the Issuer as to completeness or accuracy of the Structure Diagram.

Confidential Information

Please note that the recipients of this offer are required to keep all information regarding the Notes, the Loan Note Deed, and the Trust (the Confidential Information), confidential. Recipients are not to discuss the Confidential Information with each other or disclose any details to any third parties without the prior written consent of the Issuer. This letter must not be reproduced, used or given to any other person, in whole or in part, for any purpose other than that for which it is intended.

For the avoidance of doubt, the Issuer may disclose any Confidential Information and the information contained in this letter as required by law or regulation or by any applicable stock exchange without the need to obtain any prior approval or consent.

Singaporean Selling Legend

The offer, issue, and sale of the Notes are and will be exempt from the registration and prospectus delivery requirements of the Securities and Futures Act of Singapore 2001 (SFA), and have not and will not be lodged or registered as a prospectus with the Monetary Authority of Singapore. Accordingly, statutory liability under the SFA in relation to the content of prospectuses does not apply, and you should consider carefully whether the investment is suitable for you. The Monetary Authority of Singapore assumes no responsibility for the contents of this document or any other document or material related to the offer, issue, and sale of the Notes. This offer and any other document or material in connection with the offer or sale, or invitation for subscription or purchase, of the Notes may not be circulated or distributed, nor may the Notes be offered or sold, or be made the subject of an invitation for subscription or purchase, whether directly or indirectly, to any person in Singapore other than pursuant to, and in accordance with the conditions of, any other applicable provision of the SFA. The offer of the Notes relates to schemes which are not authorised or recognised by the Monetary Authority of Singapore and are not allowed to be offered to the retail public.

Process

If you are interested in participating as a noteholder under the Loan Note Deed you are requested to sign and return the below expression of interest by no later than 13 April 2026 to:

Wingate Financial Services Pty Ltd

Level 48, 101 Collins Street, Melbourne, Victoria 3000

Attention: Michael Sack

Email: msack@wingate.com.au

By countersigning this letter, you are merely expressing your interest to participate as a noteholder under the Loan Note Deed. Such expression of interest is non-binding and is not intended to indicate your approval of the Term Sheet.

By countersigning this letter, you represent and warrant that your institution is not, so far as you have actual knowledge or grounds to suspect, an Offshore Associate of the Issuer.

Countersigned by

Signed:_____________________________

Name: _____________________________

Title: _____________________________

Schedule 1 – Term Sheet

WIP CAPITAL INVESTMENTS TRUST

Terms

| |

Issuer

| [ 메디채널 황정호 기자 ] WIP Capital Investments Pty Ltd (ACN 686 632 066) acts as trustee for the Trust.

|

Trust

| An Australian unit trust established to make direct or indirect debt investments

|

Domicile

| Australia.

|

Investment

| Wingate Financial Services Pty Ltd (ACN 106 480 602).

|

The offer

| An offer to subscribe for loan notes on the terms described in the Loan Note Deed.

|

Issue Maximum

| AU$100 million excluding co-investments, or as determined by the Issuer from

|

Currency

| Australian Dollars (AUD).

|

Security

| Unsecured.

|

Interest payment

| Interest is linked to the underlying loans and it is targeting a return equal to the

|

Purpose

| The Issuer will establish the Trust to gain exposure to borrowers situated in

|

Term

| 5 years from closing plus extension for up to 1 additional year, provided that if the

|

Currency Hedging

| None. The Trust will make loan investments in AUD.

|

Fees

| Nil.

|

Early Prepayment

| The Noteholder may request early prepayment of any or all of its Notes on a

|

Limitation of

| The Issuer enters into the transaction documents (including Loan Note Deed) only

|

Transferability

| The Noteholder can only transfer any or all of its Notes if the Issuer, in its sole

|

Governing Law

| Victoria, Australia.

|

Schedule 2 – Structure Diagram